Kainos, Revenue Growth & Net Revenue Retention

What Drives Revenue Growth?

For much of 2022, I’ve been discussing the topic of revenue growth with senior executives of B2B companies.

What drives it? What capabilities do companies need for growth? Is Net Revenue Retention (NRR) a good predictor of profitable growth? If not, what is?

One of the most interesting discussions I had was with Brendan Mooney, CEO of IT services company Kainos. The reason I was keen to have a chat with him should be clear when you look at the table below.

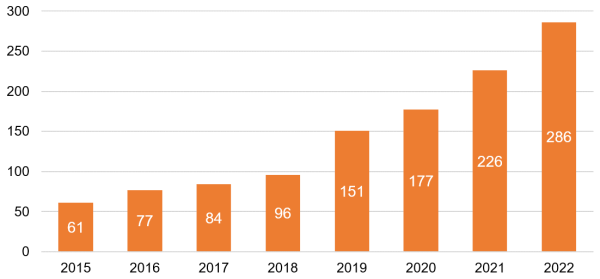

Table 1. Revenues at Kainos, excluding acquired companies (£m, 2015-2022)

NRR Explained

Net Revenue Retention is not yet a commonly-used financial term in business even though it is a well-known term in Software as a Service (SaaS) companies.

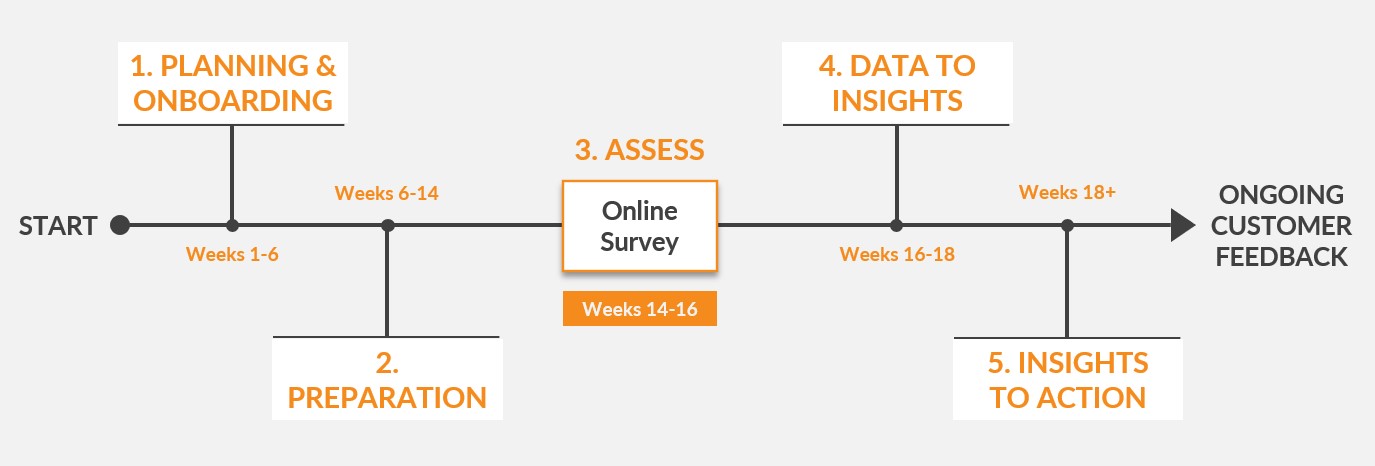

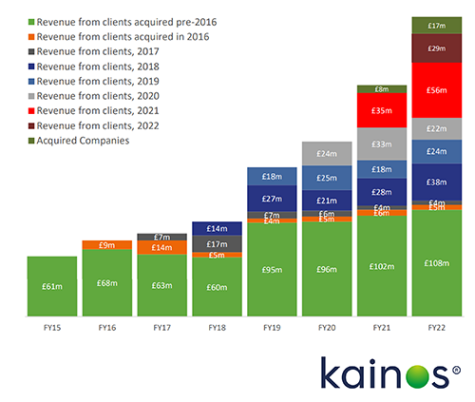

Let’s look at Kainos’ revenues from a NRR perspective. Let’s group revenues by the year in which they were acquired.

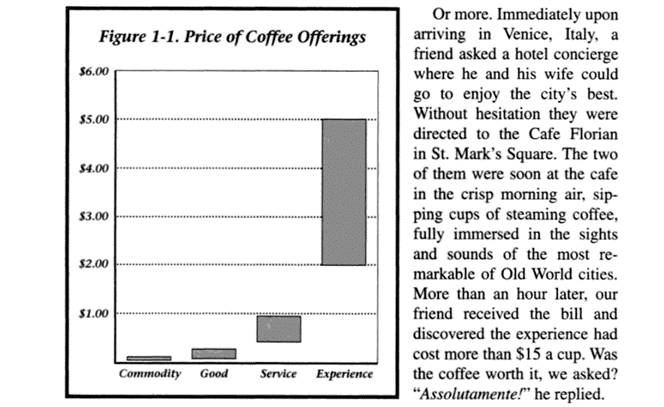

The graph on the right shows that in 2015, Kainos generated revenues of £61m.

Now suppose Kainos signed up no new clients in 2016. Its revenues would still have grown as the clients that were on its books in 2015 generated revenues of £68m in 2016.

Here’s the NRR calculation:

Kainos’ Net Revenue Retention for 2016 is:

NRR = £68m ÷ £61m = 111%

NRR At Kainos

Kainos may not be a household name but since it floated on the London Stock Exchange in 2015, it has been growing revenues organically by 20-30% a year. That’s 20-30% a year every year. Without fail. How many companies can claim revenue growth like this over the past eight years?

I certainly know of very few companies with such a track record. Some of our own clients at Deep-Insight are struggling to achieve any organic growth at the moment. So that’s why I wanted to talk to Brendan. I was really curious to find out how Kainos achieved such consistent growth. What was their secret sauce?

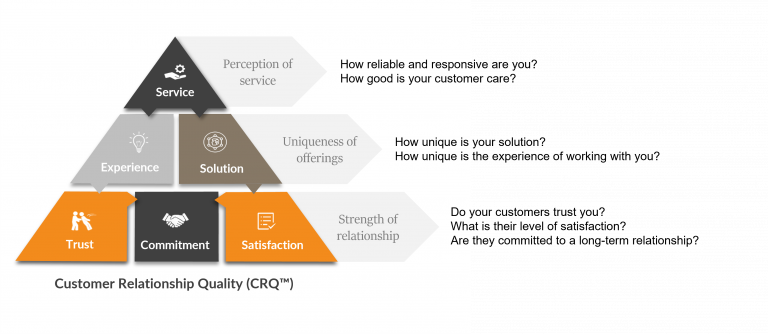

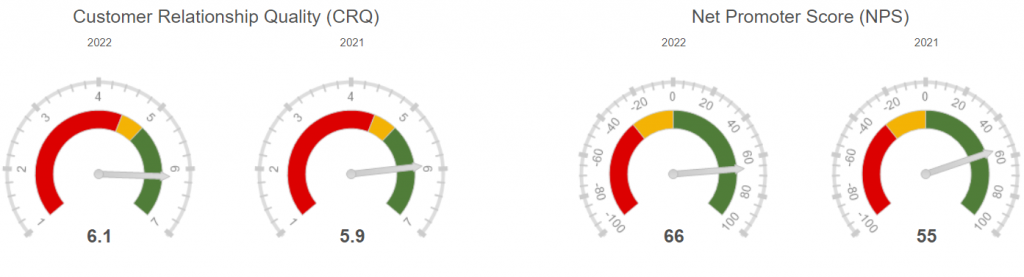

It turns out that the real secret to Kainos’ phenomenal growth is their great Net Revenue Retention (NRR) rates but, more importantly, those NRR figures are the outcome of consistently excellent service delivery for their clients.

Large B2B companies with NRRs consistently above 100% can be considered ‘very good’. Any company with an NRR above 110% should be considered as ‘excellent’. Brendan Mooney sets the bar higher and believes you need an NRR of 115% to be considered ‘Best in Class’.

Kainos is a high growth, high profit company precisely because its NRR figures are so strong. In its eight years as a publicly-quoted company, its NRR has only once dropped below 100%. In 2019, it hit 139%. Kainos is certainly ‘Best in Class’ and is a role model for any company trying to achieve above-average revenue and profit growth.

NRR is not a difficult concept to grasp but few senior executives truly understand the power of monitoring their company’s NRR performance. The reason for this is that most B2B leadership teams don’t understand how much it costs to land a ‘Net New’ client (brand new logo). If they did, they would become obsessed with retention in general, and NRR in particular as a key metric to monitor.

Which is More Important: Land, Expand or Retain?

Many companies grow revenues by investing heavily in new sales. It works. But it’s expensive – much more expensive than people think. Our analysis at Deep-Insight shows that it typically takes 4-6 years to break even when you sign up a new client. If CFOs and leadership teams measured Customer Lifetime Value (CLV) – and most don’t – they would realise that a significant proportion of their clients never make a profit. The reason? They don’t hang on to those clients long enough for them to pay back the acquisition cost and break even.

In some cases, a company’s ability to Land a large number of ‘Net New’ clients each year can mask a failure to Expand its footprint across those accounts, and/or a failure to Retain those clients over the longer term.

Companies can grow revenues by investing heavily in new sales but it’s difficult to stay profitable if all you’re doing is replacing existing clients with expensive new logos, many of which never stay around to generate a profit.

So why is NRR so important? The answer is that you can achieve growth with an NRR performance well below 100% but it’s rarely sustainable. Profitable growth always trumps revenue growth. Expanding and Retaining are far more important activities than Landing.

Who Needs New Clients Anyway?

Here’s another thing: if your NRR is consistently above 100%, you don’t need ANY new clients to grow your business.

Just think about that for a minute. I’ve said that it’s expensive to acquire a new client in the first place. It’s not just the cost of the salespeople who win the bid. You also have to factor all the time and money they spend on bids that they DON’T win.

We’re not suggesting that companies disband their sales teams. We are suggesting that they become much more discerning in what they bid for, and once they sign up a ‘Net New’ client, they need to organise themselves to retain those clients for, well, pretty much forever. They also need to figure out a good strategy for expansion across that account – finding additional products and value-added services to cross-sell.

And that’s what Kainos does really, really well.

From Campus Company To FTSE 250 Star

Let’s get back to Brendan Mooney and Kainos. Brendan joined the company as a trainee software engineer from Ulster University in 1989.

At the time, Kainos was a small university campus company with around 25 employees. It was a joint venture between Fujitsu and Queens University, Belfast. Most of its work was for Fujitsu in Great Britain. Brendan was one of two graduates hired from Ulster University that year. Both still work at Kainos, which might give a hint at why the company has been so successful over the years.

Brendan started working in Dublin in 1994 as Kainos started to expand its footprint across the island of Ireland. In 2001, he took over as CEO. Roll forward a few years. In 2015 Kainos floated on the London Stock Exchange. Today it is a constituent on the FTSE 250 Index.

I asked Brendan why Kainos was not as well-known as other IT service providers, despite its hugely impressive track record. His answer was simple: “We do our best marketing by delivering for our customers”.

In terms of brand awareness, our customers – and those who we want to do business with – know us quite well. We’re also probably well-known inside universities because that’s our heritage and where we target students for recruitment. But yeah, I guess we don't have a particularly high public profile.

The thing is that we do our best work by delivering for our customers. That’s where we put our energy and enthusiasm, and that gives us the results and recognition we’re looking for. For us, it’s all about the ongoing relationship with our customers.

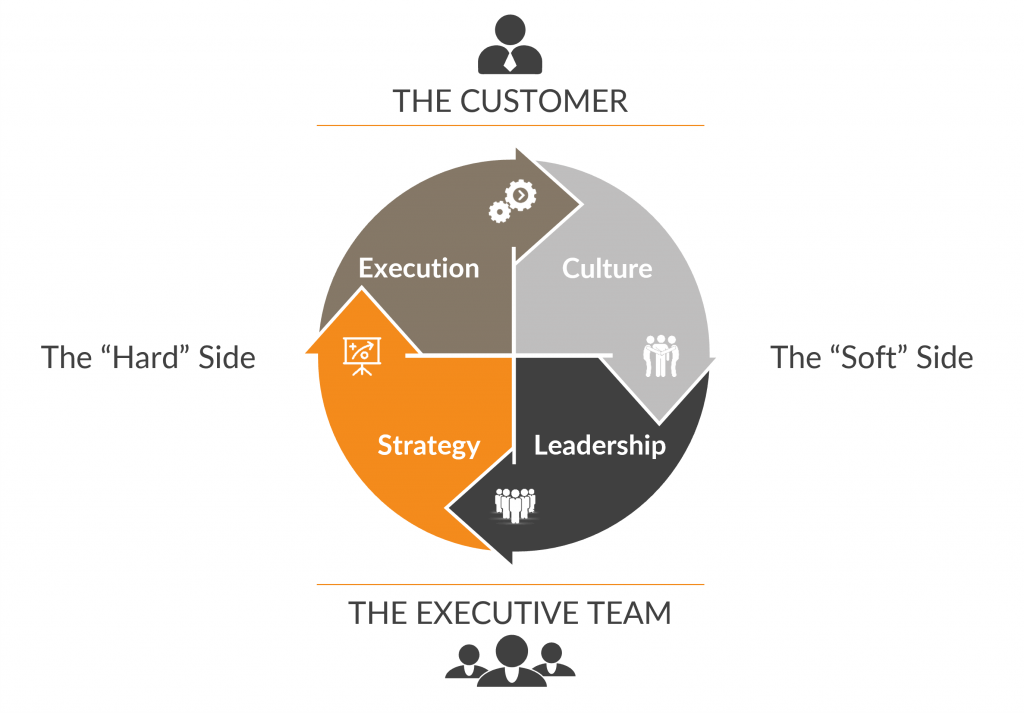

Engage, Deliver, Grow

When I talked to Brendan Mooney about Landing, Expanding and Retaining clients, he said he preferred to use a different phrase: Engage, Deliver, Grow.

His explanation goes to the heart of the NRR/Growth challenge, and it’s a hard-nosed commercial view. Kainos is very focused on profit margins – particularly where there a likelihood of margin erosion. In Brendan’s view, the best way to hold profit margins and reduce erosion is to manage Engagement Efficiency. Here’s how he defines it:

So you've made promises during the sales campaign. Now you have to deliver against those promises and commitments. And if I think about profit margins in a contract, there are three points of margin erosion in a ‘Net New’ client – three areas where you incur additional costs or give away margin.

COST NUMBER 1 is the cost of a sales team. Good salespeople are well paid. They have a pre-sales team that supports them. They don't win every bid. There's the lost business cost you need to factor in as well. So that's cost number one.

COST NUMBER 2 is competitive pricing. For a ‘Net New’ client, it’s typically a competitive bid. It doesn't matter how disciplined you are as a sales professional, your instinct will be to price more keenly than the competition in order to win. The client will always tell you price is a problem, and you know it’s going to be part of the conversation with a professional procurement team...

But actually, COST NUMBER 3, which relates to ‘Engagement Efficiency’, is the key one. That’s what drives our view about the reciprocal nature of a long term relationship. Because we've had a significant cost in winning that client, we want to see that client retained 15 or 20 years, obviously even longer. Then what do you do? You put a really strong team on that first engagement. When you start any new project, you don't know the client very well. But are they sure about their outcome they're trying to achieve? How competent are they as an organisation to deliver their part of the overall project plan? And if they're using third party suppliers, how responsive will they be in that project? We can't control all those factors but we can control the quality of our people. So we put on a very experienced team for that first engagement to provide us some degree of flex, in case anything happens, which it usually does.

In summary, Kainos stacks the initial engagement with very experienced people. That’s precisely because Brendan Mooney knows that if something can go wrong in those initial months, it probably will. Kainos needs experienced people to be able to handle all eventualities and still deliver a really successful Phase 1 of the engagement.

Once that initial phase has been delivered, Kainos can change the mix on the project team. But that initial phase is crucial to build Kainos’ reputation. It will build the trust their clients have in Kainos as an organisation and as a true business partner.

Get the Engage and Deliver elements right and the Grow piece becomes a lot easier.

Getting The Balance Right

And if it sounds like Kainos is purely a company focused on numbers and profit margins, it’s not. Brendan Mooney was quick to point out that “it’s all about balance”.

As a business, Kainos sets out three ambitions, all of which are important, but they do have a priority order. These are, in priority:

- Being a great employer

- Delivering value to our customers

- Being a growing, profitable and responsible business

The apex of Kainos’ pyramid is its people. It works hard at keeping the talent that it has, as well as attracting more great people. Unlike its NRR rates, Kainos can’t achieve a people retention figure of greater than 100% but its current figure of 86% compares well against the market.

Growth = Consistently Good Service Delivery

When it comes to that third point about growth, Brendan’s philosophy is simple: “If you want to build your business, keep your current clients. Then you can expand in terms of the other share of their expenditure. That’s our thought process.”

And at the heart of that philosophy is a drive and obsession with delivery excellence. Consistently good service delivery helps build trust and commitment and those elements are the key to any long-term business partnership.

I joined an organisation that was young but had a very mature view about delivery. And it was about the premise that if you delivered to your client and you helped them achieve their business objectives, then they would come to you in the future to place business with you.

For us, it's all about delivery – I can't explain it another way. So it's not a complicated concept at all. But the important thing here is the delivery.

Our sales team will always point out that the reason we won that bid was because of our delivery reputation. The reason we won a DEFRA contract for £54 million was that we did Phase One so well that the client was just blown away.

Or the reason that we had a £92 million contract with the Passport Office in the UK was that for the previous four and a half years we had managed to beat every single deadline they'd set into their plan.

And we're easy to work with – that's important too. But if you don’t have that delivery capability, it’s so much harder for any sales or account manager to win. And again, it's a community that self-references quite quickly.

The UK is a bigger place than Ireland, but it's not an enormous place. People will be able to find out about you quite quickly, if you fail to deliver a project.

Key Takeaway

In my interview with Brendan Mooney, we covered a few other topics as well. We talked about how it wasn’t all plain sailing, particularly during the banking crisis in 2008 when many of Kainos’ clients were financial services companies; how they diversified into international markets and made the strategic move to start supporting Workday clients; and the more recent move into digital transformation and agile software development practices.

However, the key takeaway from my interview with Brendan Mooney was this: If you want to grow revenues consistently over time, you need to have a really well-structured approach to engaging with the right clients, and then delivering the goods for them time after time after time.

It’s not rocket science. But that doesn’t mean that it’s easy.