Actually, it was really about how some of our clients are maintaining business relationships while they are locked down at home but still have access to a telephone or the internet.

So here’s a summary of the 5 actions for maintaining long-lasting business relationships in the “time of corona”.

John O’Connor

CEO, Deep-Insight

********************

My Role as a Relationship Counsellor

Good morning. I’m John O’Connor, CEO of Deep-Insight. I sometimes refer to myself as a relationship counsellor. We set up and run Customer Experience programmes for large international B2B companies. Our clients are the likes of Atos, BT, Serco, Santander and so on. We also run Employee Engagement programmes and I’ll talk about one client in the course of the next 10 minutes but primarily it’s the MDs and Sales Directors of B2B companies that we deal with.

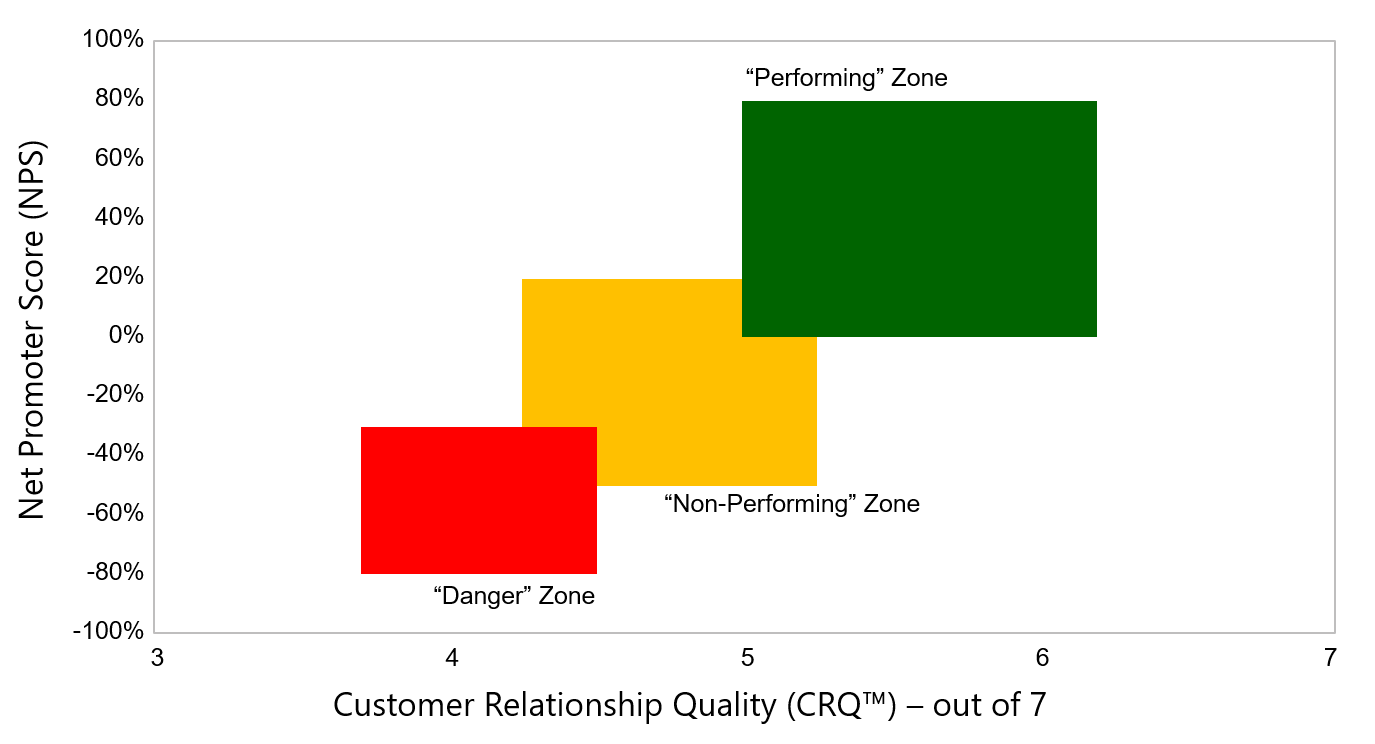

I call myself a relationship counsellor because our job is to help senior executives understand and enhance the relationships they have with major accounts. We do this by telling them:

- Which of their accounts are in good shape and which are like to defect to the competition;

- Which account managers are doing a good job at building long-term relationships within those accounts;

- What is the one thing that they as senior executives need to address in 2020 because it’s an issue across all of the client base.

What is a B2B relationship?

Well, it’s largely built around two elements: Trust and Commitment.

The theory is quite simple: people only buy from people that they trust. Long term commitment between two business partners is based on exactly that – a relationship built on Trust. Although B2B stands for business to business, I often say it’s really P2P (Person to Person). Organisations don’t buy from organisations. It’s people who buy from each other, even when they work in large organisations.

5 Actions You Need to Take

So keeping that in mind, how should we deal with our clients in the current environment? I’ve been reflecting on what some of our clients are doing with their customers and it seems to boil down to five things. These five actions are all based on building an emotional connection with clients and enhancing that client relationship:

1. Tell Customers how you are Contributing to Safety

2. Treat Customers with Care and Empathy

3. Communicate Constantly and Consistently

4. Treat Employees with Respect

5. There is no fifth action: Just make sure you do Actions 1 – 4

1. Contributing to Safety

This first point may not apply to every company but it probably does apply to most. Tell your customers what you are doing to contribute to their safety. After all, this whole COVID19 pandemic is primarily an issue of human safety. People out there are naturally concerned both from a personal and from a professional point of view.

Some of our clients deal with safety for a living. For example, one of our clients is a company called Survitec. It has over 3,000 employees manufacturing safety equipment for Defence and Marine clients. We’re working with the Marine division which manufactures everything from life jackets to the largest lifeboats you’ve ever seen. Their clients include cruise companies, oil & gas organisations, ship manufacturers, ship managers and so on.

Let’s take something like a lifeboat inspection. In the last few weeks, Survitec has literally re-written the manual for doing a lifeboat inspection. It had to, to make sure that it complied with WHO guidelines on things like workers practicing social distancing, the wearing of gloves and face masks, the basics of handwashing and use of hand sanitisers; on carrying out deep cleans after work has been completed. All shipments that are sent from Survitec’s warehouses are cleaned and wiped down before being dispatched.

But there’s not much point in rewriting the manual if you don’t also tell clients that you have done so. That’s what Survitec has been doing.

2. Treating Customers with Care and Empathy

Quite a few of our clients have customers that operate in industries that have been hard hit by COVID-19. I’ve already mentioned Survitec and the fact that it works with cruise companies. Now that’s a tough industry to be in at the moment.

We have another client called Timico which provides a range of IT services to UK clients. Many of these are operating in the restaurant and retail industry. These companies are hurting – both at a corporate level and at a personal level. A lot of what Timico has been doing in recent weeks is talking to their clients, understanding what their particular circumstances are and, in many cases, renegotiating deals and contracts based on the reality of what’s happening in their industry at the moment. For Timico it’s all about “providing confidence that they are doing everything they can to support their customers”.

I’m sure you have clients in a similar position. Be like Timico. Be empathetic. Go into listening mode.

3. Communicating Constantly and Consistently

Remember that communication is two-way. It’s about listening as much as it is telling. In fact, it should be a lot more listening that telling, in the current environment.

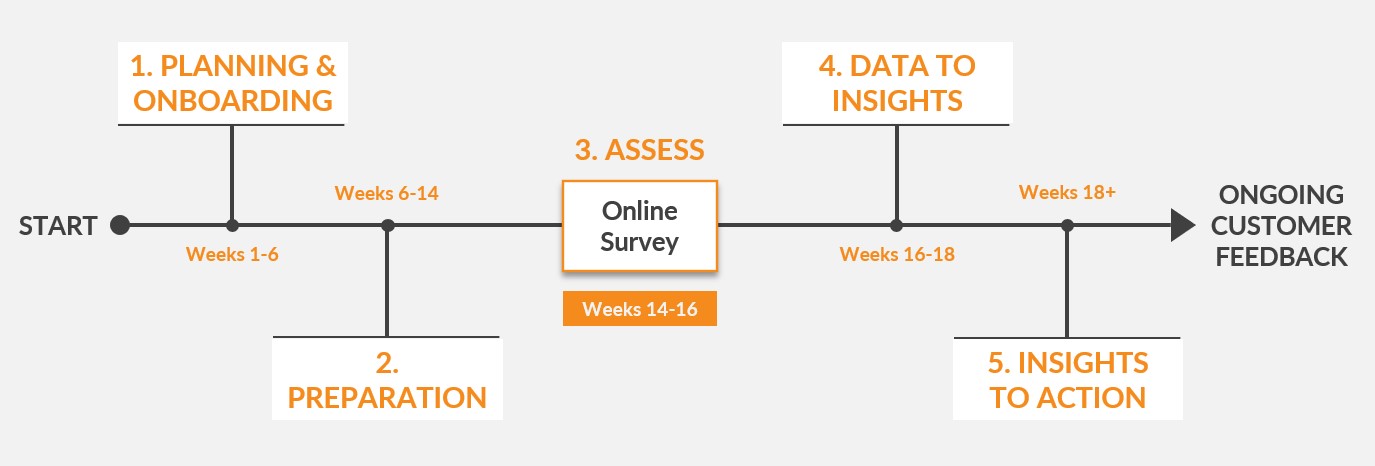

We have another client called Invenio that has about 1,000 staff deployed on large technical projects all across the globe – Americas, Europe, Middle East, Asia, Africa. Last Friday, we completed a customer feedback programme for them and while there was some debate at the start of April about whether we should go ahead, the CEO Arun Bala decided – correctly – that now was absolutely the right time to find out what his clients were thinking. As of this morning, we’re going through all the feedback with the various Invenio account owners. The next step is for those account owners to go back to their clients, share and discuss the feedback, and come up with action plans to address any issues.

4. Treating Employees with Respect

You might say this is not related to customers but remember that your staff are the daily interface your company has with clients. Treat them in exactly the same way that you treat your customers. Put it another way: “How can you expect your staff to provide a great customer experience when they are not having a great employee experience?”

Now, more than ever, your customers will judge how you deal with them currently when they consider who they do business with in the future. You probably know there are lists circulating in the UK naming companies who have provided bad customer and/or employee experience!

We have a Danish client called Pelican that operates a series of self-storage facilities for small businesses and for consumers all across the Nordic region. Most of their sites only have two staff so good communication with employees is again a key requirement for Pelican’s management team. Two weeks ago, we completed an employee assessment for Burkhart Franz, the CEO of Pelican, and I’m going to read you two comments that came back from staff in that assessment:

“Since Pelican has taken quick actions during this corona crisis, my trust in our company has grown. My score is higher than before due to this fact.”

“It’s really nice in this hard Corona situation that I can trust my employer. At the moment I have no worries about losing my job or salary, like many of my friends and family. Thank you for that!”

Now even if Burkhart wasn’t in a position to make any financial commitment to his employees, he’s the sort of guy who will let employees know exactly where they stand and what is likely to happen. And they really appreciate it. Be like Burkhart. List to your employees. Do it now.

Summary

So here are my key messages again:

1. Tell Customers how you are Contributing to Safety

2. Treat Customers with Care and Empathy

3. Communicate Constantly and Consistently

4. Treat Employees with Respect

If you need a fifth message, it to spend a lot of time thinking about the other four, because these are actions that companies need to take now, not just because they’re the right thing to do, but because they make sense commercially as well.

I’ll finish off with a message from a recent conversation I had recently with Ed Stainton, who manages the major government accounts for BT including the relationships with various police forces across the country. Based on their most recent customer assessment, we know that Ed already has a fantastic set of relationships with his clients but he’s convinced that in the next Deep-Insight assessment, the scores will be even better. Ed is convinced that this is the case because his teams have been working 24 x 7 throughout March and April on a whole range of activities directly or indirectly related to COVID-19. Ed believes that enhanced contact is going to lead to better and deeper client relationships. I think he’s right.

Thank you for listening and remember: be like Survitec and Invenio! Be like Arun, Burkhart and Ed!