Photo: Sanne Donders

Interview with René Versluis, NPS Expert

KPN is a leading telecommunications and IT provider and market leader here in the Netherlands. As well as supporting several million consumers, KPN also supports corporate customers in the areas of infrastructure, workplace management, the cloud, security, data networks and data centres.

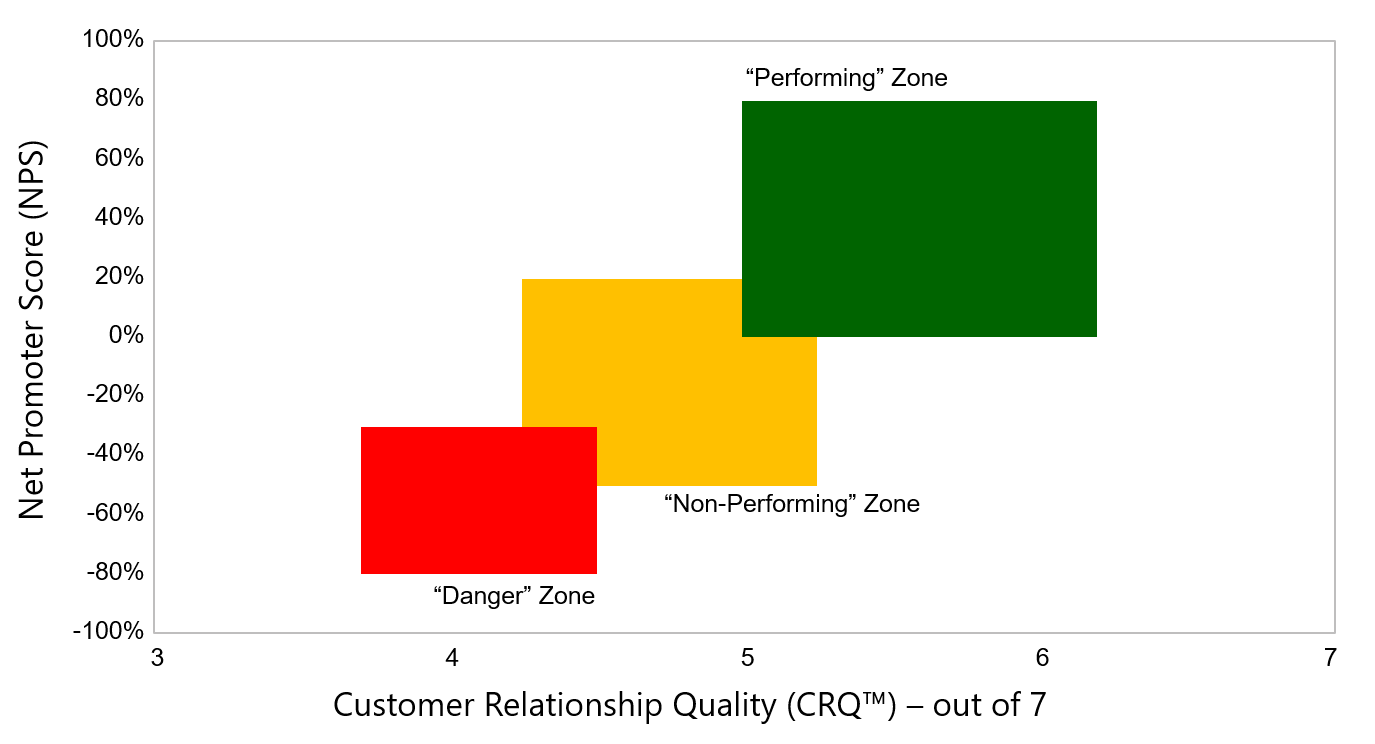

Our CEO John O’Connor recently caught up with René Versluis, who has been responsible for running the Net Promoter Score (NPS) programme at KPN’s corporate division for several years. René is a genuine expert in running a customer feedback programme in a large corporate business to business (B2B) environment.

I hope you enjoy this short interview with René Versluis.

Pim Braat

Deep-Insight Regional Manager, Benelux

_________________________

René Versluis and NPS

John: René can you tell me a little bit about yourself and your involvement with Net Promotor Scores (NPS)?

René: Sure, John. I have worked with KPN for more than 15 years and I have had a series of commercial and sales roles during that time. In recent years, I have been a programme director for some of KPN’s strategic projects including responsibility for setting up and running its Net Promoter Score (NPS) programme for corporate clients. The trigger for KPN creating that role and asking me to take ownership was the fact that KPN values its corporate clients and is interested in their feedback in the fast developing world.

The Importance of Good Governance and Follow-Up

John: What were the first things you did when you took on this new role?

René: Leadership is important so my very first step was to create an NPS board which included many of the senior leaders in the company. We met initially every single week. This was an important step in setting the right governance for the programme.

John: Would you say that the NPS programme was successful?

René: Yes, I would say we had a lot of success with the NPS programme. We got feedback from customers but more important, we took action. If a client score needed to be improved, we implemented a Client Improvement Plan. We also insisted on closed loop feedback with each client. That means that within four weeks of a survey taking place, the account director created this Client Improvement Plan and discussed, agreed and shared that plan with the client.

Lessons Learned

John: What lessons did you learn from running the programme? Or to put the question a different way, what advice would you give to yourself if you were to start all over again?

René: I don’t think I would have changed anything fundamentally. I have mentioned the importance of leadership. The other thing that is important is setting realistic targets. You can’t change the culture of an organisation if you set targets that are not achievable.

John: How did the NPS Board change the culture in the organisation to make it more customer-centric?

René: One of the techniques that we used when people came to us with a proposition was to ask them: “What is the effect of that on the NPS score?” If you keep asking that question, eventually people recognise that any proposal or any investment needs to be made with the customer in mind. If it’s not and people can’t articulate a clear benefit for the customer, then it’s a wasted investment. I would also say that you need to work very closely with key clients – you can’t assume that you have the right answer. You must make sure the client thinks it’s the right answer.

The Future

John: You’ve recently left KPN after more than 15 years. What do you plan to do now?

René: I’m not ready to retire just yet! I think I have learned enough from my time at KPN to help other companies thinking about embarking on their customer experience of NPS programmes. Net Promoter is a great tool but it needs to be applied correctly in B2B environments.

John: The very best of luck, René, and thanks again for sharing those insights with us.