Trust and Commitment

The following words are from two American academics Rob Morgan and Shelby Hunt. We’ll come to these guys shortly.

“Commitment and trust, rather than (or at least in addition to) power and dependence, are now central to discussions of business relationships.

Researchers and practitioners have come to view most interactions between business parties as events that occur over the course of a relationship between two or more partners.”

Here’s a funny thing about business-to-business (B2B). It’s less about business and more about relationships. In fact, B2B is really P2P: person-to-person. People buy from people. In large organisations, the decision to go with one particular service provider over another is often down to the answer to one simple question: “Do I really want to work with this person?”

The answer to that question is usually based on the perception of whether the individual can be trusted or not. Without trust, there can be no commitment.

I thought companies bought mainly on price?

Companies generally put large business contracts out to tender. They will produce a clear set of evaluation criteria to help guide their choice of service provider. Price is always one of the evaluation metrics. Even so, the final decision is often made on softer and unwritten criteria. Price is rarely the deciding factor. Often, they are made on a combination of price and solution/ functionality. But when it comes to making the final choice to award any contract, subtle psychological elements come into play.

“OK, I know these guys seem to have the [INSERT: ‘best product’, ‘lowest price’, ‘most innovative solution’]. But what if it all goes wrong? Will they sort out the issues or will they leave me in the lurch? Will I lose my job?”

Fundamentally, we like to buy from people we think are honest, who treat us fairly and who act with integrity. In other words, we buy from people we trust. Price is generally a secondary consideration. It can’t be ignored but rarely is it the most important factor in the decision-making.

Morgan and Hunt

Two American academics figured this out a long time ago. In 1994, Rob Morgan and Shelby Hunt wrote a seminal paper on what really drives a long-term relationship between two business partners.

The Commitment-Trust Theory of Relationship Marketing quickly became a hit, not just in academic circles, but among senior business executives who were trying to identify why people were likely to do business with you.

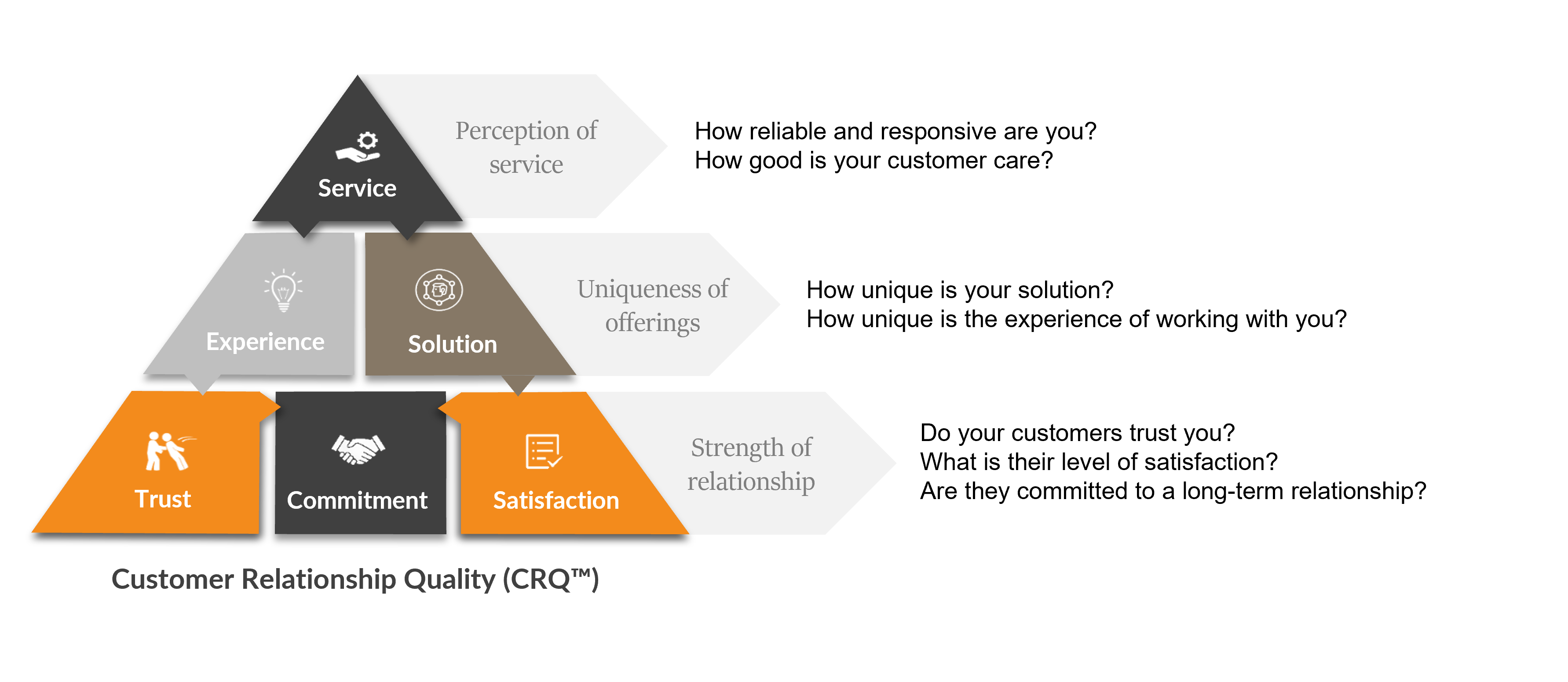

Morgan and Hunt realised that long-term business relationships are built on a mutual and cooperative working relationship between two partner firms. Focus on Trust and Commitment if you want to foster and nurture such relationships. That’s why we built these key metrics into the heart of our Customer Relationship Quality (CRQ) methodology.

Customer Relationship Quality (CRQ)

Deep-Insight’s CRQ model works on three levels. Let’s take a quick look at each level. From the bottom up:

The Relationship Level

Trust and Commitment are the most important building blocks for a good relationship but don’t ignore Satisfaction. This is simply a measure of whether the customer’s expectations have been met or exceeded. Satisfaction is quite transactional. Customers can be happy one day and deeply unhappy the next, if they experience a problem. If the problem is solved, satisfaction levels increase quickly.

The Uniqueness Level

Experience is a measure of how easy you are to do business with and if you are seen as a trusted partner. You can have the best products or services in the world but if your clients can’t work with you and don’t see your people as trusted partners, you will not be seen as ‘Unique’. Deep-Insight defines Solution as a combination of Innovation, Leading Edge and Value-For-Money. These are three related but slightly different concepts but if you score well on all three, you have an offering that can help your clients compete in the marketplace in a way that none of your competitors can do. When we talk about ‘Solution’ we’re not just talking ‘Product’. It’s as much about how the account managers, sales and delivery teams position your company’s product or service, as it is about the product or service itself.

The Service Level

Service covers three separate elements: Reliability, Responsiveness and Customer Care. Reliability measures whether or not you do what you say you do. Do you walk the talk? Do you do what you promise? Essentially, can your clients rely on you (and the ‘you’ refers to both the brand and the individuals working with the client). Responsiveness measures whether or not you react quickly to issues that arise. Better, still, are you proactive in anticipating customers’ needs or issues. Customer Care is all about making the customer feel valued.

Are you interested in building Trust and Commitment with your key clients? Would you like to find out more about our Customer Relationship Quality (CRQ) model? If the answer to either question is yes, contact us today.