Am I better than the competition?

If I got a penny for every time a client has asked “How do we compare against our competitors?” or “How are we doing against the benchmark for our industry?” I’d be a rich man. But the thing is that B2B benchmarking is not a good idea.

Seriously. You should strive to be a ‘Unique’ company and not an average company.

Most of our clients want to know how they are doing against the benchmark score for their industry. My response: “If you really aspire to being a mediocre company, then I’ll tell you what the average score is for your industry and how you compare against the average. But you can do better than that. You can be UNIQUE.”

In fairness, some of our clients have latched on to the message that they should ignore the competition. They should focus purely on being indispensable to their existing customers. Still, it’s tempting to see where you stand in a league tables against your industry peers.

So let me ask a few questions about why you want to do benchmarking. Because B2B benchmarking is not a good idea!

What exactly is your industry?

Are you in the insurance industry, or the insurance broking industry? Or are you in both? Or re you an outsourcing company that specialises in insurance third-party processing?

They’re all in the insurance world but these are very different industries. They have different dynamics and there are differences in average scores from one industry to the next. For example, we know from experience that many IT and most BPO (Business Process Outsourcing) companies tend to get lower than average scores, while corporate banking and professional services companies tend to get higher than average scores. Firms operating in niche markets also find it easier to be seen as different and unique.

If I say you’re at the industry benchmark, will you really be happy?

If you aspire to hit the average score for your industry, or your country, you’re setting the bar pretty low. What you’re telling me is that you want to be an average company.

To take my point to its extreme, benchmarking is little more than a recipe for mediocrity.

Do you realise that international benchmarks are inherently flawed?

This is not just because the insurance broking or widget-manufacturing markets in the Netherlands have a completely different structure than they do in Australia. It’s also because Dutch and Australian clients have completely different approaches to the way they answer customer surveys.

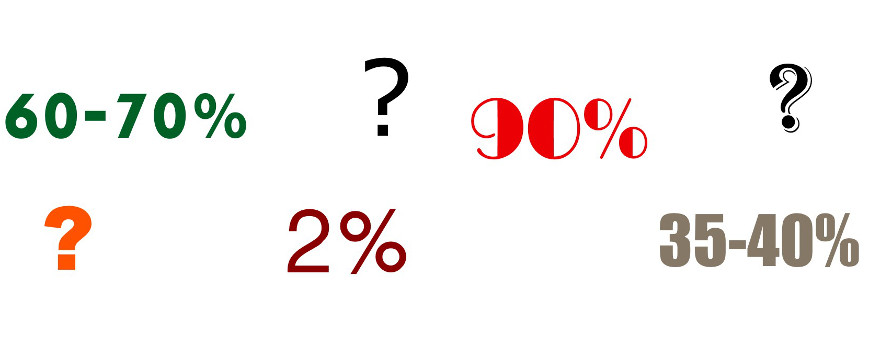

There are some good academic papers on how different nationalities are pre-disposed to answering questionnaires differently. Let me give just one example. Some people will claim that the average Net Promoter Score (NPS) for B2B companies is between 25% and 30%, regardless of industry. However, these figures are heavily skewed towards US companies.

Our experience of gathering NPS scores across 86 different countries since 2006 is that the average NPS score for any B2B industry is closer to 10%. But then again, our clients are more heavily weighted towards European and Australian respondents, who generally tend to score less positively than their American counterparts.

But I still want to benchmark my performance!

I thought you might say that.

If you really do want to benchmark yourself, then let me suggest that you approach the subject of benchmarking in a slightly different fashion:

- START BY SETTING THE BAR HIGHER. Aspire to be the best, or at the very least to be ‘Unique’ in the eyes of your customers. Our database at Deep-Insight shows that only 10% of B2B companies are considered Unique by their clients, but these Unique companies have significantly stronger relationships – and retention rates – than the ‘average’ company. Unique companies typically have twice the number of Ambassadors and have NPS scores of 30% or more.

- BENCHMARK YOURSELF AGAINST YOUR OWN PERFORMANCE LAST YEAR. That’s a much more reliable way of seeing if you are becoming more customer-centric or not. The journey to becoming a customer-centric organisation is a long one – don’t think you’re going to achieve it in anything less than three years – so be sure to check your progress formally on at least an annual basis.

- BENCHMARK YOURSELF INTERNALLY. See what your clients think of you, compared to the scores that are achieved by other divisions or business lines within the same company. If you’re an international company, benchmark yourself against other geographies (but watch out for the cultural differences between, say, American and European divisions.)

Remember that B2B benchmarking is not a good idea. It’s not a BAD idea. It’s just that you should ignore the competition and become unique for your customers.

Good luck!

The next question we get asked is “Is it really that high?”

The next question we get asked is “Is it really that high?”