Cobbler’s Children

There’s an old saying that “the cobbler’s children are the worst shod”. In the past that definitely applied to Deep-Insight. We advise clients like Atos, BT and Serco to build customer centricity through:

– Annual strategic assessment of all clients

– Clear plan for choosing the right contacts and getting them to commit to giving feedback via an online survey

– Comprehensive review of the feedback to agree strategic initiatives for the next 12 months

– ‘Close The Loop’ meetings with each client to agree actions to improve the relationship

In Deep-Insight’s early days, we even struggled with the first point. We thought the survey couldn’t be completely independent and honest as it was not being administered by a third party. We got over that objection pretty quickly. It’s true that our scores are a little inflated because the survey is not anonymous, but that’s not the point. The numbers aren’t the most important thing. Any customer feedback is invaluable. We have now been running CRQ assessments with our own clients on an annual basis for several years. Last year, we got our best ever scores.

The only problem is that in 2019 we probably didn’t include as wide a selection of contacts as we should and we could have worked harder at getting a higher completion rate. Last year, our completion rate was 49%. That’s not bad but this year we agreed we wouldn’t be happy unless we hit 60%.

So how did we do? Were we still the cobbler’s children?

Deep-Insight’s 2020 CRQ results

We were definitely more determined this year in getting commitments from you to give us 10 minutes of your time for feedback.

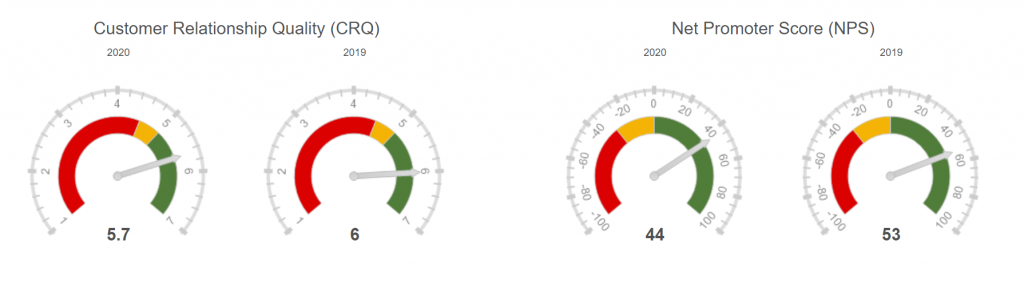

It worked – we achieved a 66% completion rate so my first message is to say ‘Thank You’ for such a wonderful response. Our results were very good too: a CRQ score of 5.7 and a Net Promoter score of +44%. Not as high as last year, but I’m still really pleased by those scores.

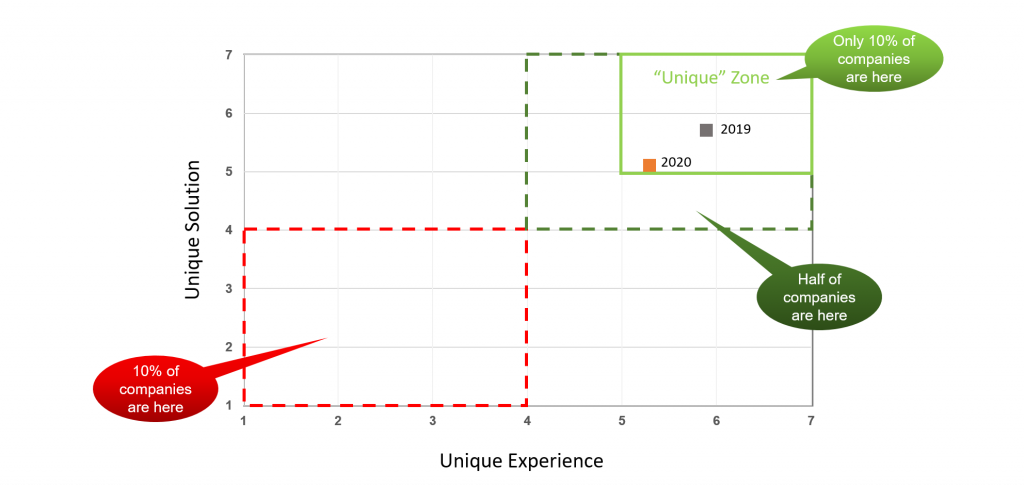

Retaining our Unique Status

We also retained our ‘Unique’ status which means that we are in the top 10% of our own database of scores. Uniqueness requires a combination of a winning ‘Solution’ and a wonderful ‘Experience’ for the client.

Areas for Improvement

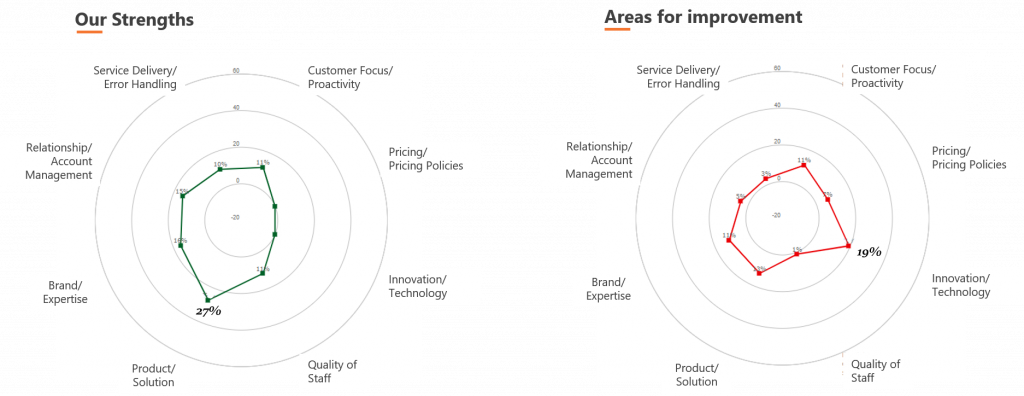

Even though our clients see us as Unique, there are still areas we need to improve upon. Our core product offering is seen as really good but, in some places, we’re not seen as innovative enough and there are a few areas where we could invest more in our technology.

Closing The Loop

At this point, we have been in touch with most of our clients and scheduled a ‘Close The Loop’ meeting to discuss their feedback on us, and to agree some actions. One of the areas we will be seeking further feedback on is where we focus our development efforts in terms of ‘Innovation’ and ‘Technology’. Here are the three areas that we are trying to prioritise:

1. Further development of Deep-Dive. Deep-Dive is our online analytical portal. It has become an invaluable tool for us to extract insights for our clients but it’s not as intuitive as it could be.

2. Integration with Salesforce. Many, if not most, of our clients use Salesforce as their corporate CRM tool. Some of our clients import the CRQ and NPS results (as well as verbatim comments) from our assessment into Salesforce so that account managers and service teams can see instantly what the most recent feedback was.

3. More Benchmarking & Industry Comparisons. We have 20 years’ worth of benchmarking data and although we’re not big believers in industry averages, many of our clients would like to know if they’re in a particular quartile or decile for their industry.

Cobbler’s Children

We’ve tried hard this year so hopefully we’re no longer the cobbler’s children. Thank you again for your time and input into this year’s CRQ customer assessment. I really do appreciate it and we will make changes based on your feedback – particularly around where we should focus our efforts in the next 12 months.

John O’Connor

CEO, Deep-Insight

Hi, it’s Shane again announcing our new client

Hi, it’s Shane again announcing our new client  Hello. I’m Fabienne.

Hello. I’m Fabienne.