If you’re a typical B2B company, the chances are that you have good or excellent relationships with the majority of your clients. But you will also have clients where your relationship is not as strong. At Deep-Insight we help you understand these client relationships by segmenting them based on the strength of their relationship with you.

Here are the five categories we use:

Customer Relationship Quality – the Strongest Relationships

The most loyal client category is the Ambassador segment. Ambassadors are your most valuable customers. They have a unique relationship with you and will recommend you to others. They are also prepared to pay a premium for your products or services – price is not an important consideration for them because of the quality of the relationship. Typically, a third of your clients are Ambassadors.

The next segment of clients are known as Rationals. They rate you positively but do not see anything unique in the relationship. Rationals will take their time to assess alternative sources of supply and the relationship can become unstable if good alternative offers exist. Typically, half of your key B2B accounts fit into this category. Generally they are good clients albeit not as loyal as Ambassadors.

The Weakest Relationships

But wait! That doesn’t add up to 100%. What’s the story with the others?

Well, the answer is that in all B2B account portfolios, there are clients that don’t love you that much. We typically find that 10-20% of accounts have poorer relationships with you and fit into one of the following three categories:

Ambivalents often have a “love/hate” relationship with you. In some instances, they love the way you solve their problems but hate the way you treat them. More often, you are killing them with kindness but failing to solve their business issues. You may think the relationship is strong but you don’t really understand their issues and can’t propose business solutions to move their business forward.

Stalkers are often only interested in price. Sometimes they can be large corporate accounts looking for special offers and discounts. Other times, they are smaller accounts that view your services as poor value for money. Stalkers see nothing unique in the relationship and often have very high service requirements. They play different competitors against each other and do not generate a positive value for your portfolio.

Opponents have the poorest relationships with you. They are deeply dissatisfied and often highly frustrated by what they see as consistently poor service. Opponents have a negative relationship with the company and generate negative value. They can sometimes be won back if the reason for their dissatisfaction is identified and addressed but, in many cases, the relationship has broken down irretrievably and they can not be won back.

Managing Ambassadors

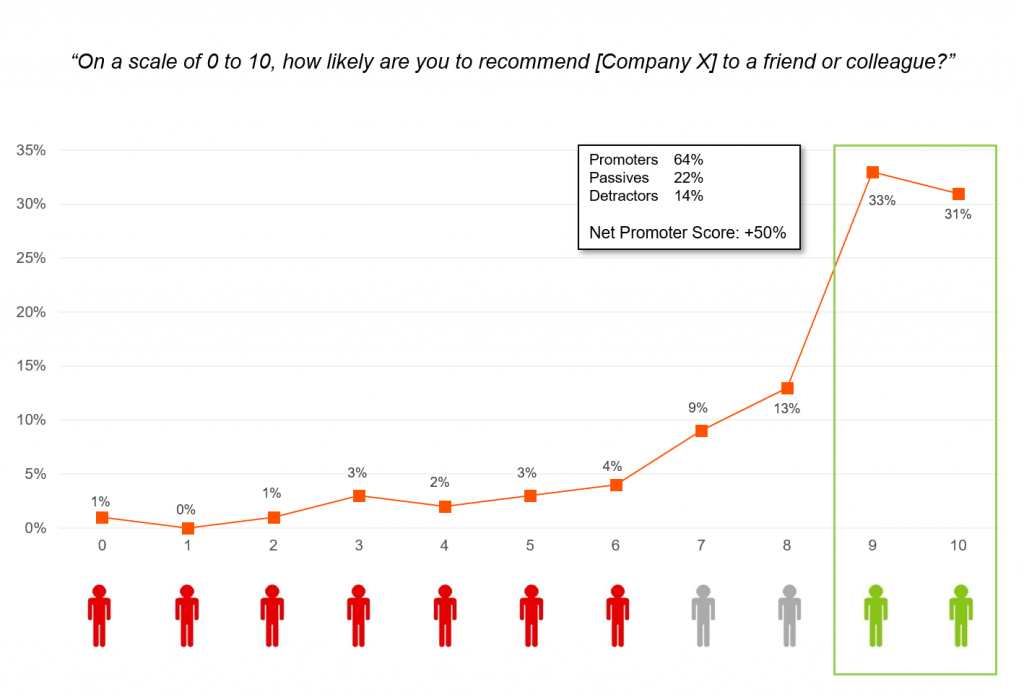

Before we look at how to manage Stalkers and Opponents – the main point of this blog – one quick point about how to manage Ambassadors. Ambassadors are willing to recommend you. So ask them for testimonials. Trustmary is a Finnish company that helps clients do exactly that using Net Promoter Score as the key metric for identifying Ambassadors.

Don’t be afraid to ask Ambassadors for testimonials or for introductions into other businesses. They want to help you. So just do it.

Managing Stalkers and Opponents

So what to do with these poorer-value relationships, particularly Stalkers and Opponents?

Three things:

1. Decide if you want to keep them or fire them

It may sound strange to talk about ‘firing’ clients but sometimes there are clients that can not be serviced effectively or profitably. Sometimes their expectations are too high, or the fit between their needs and your products or services is limited. In such cases, it’s valid to ask the question “Would we both be better off if we ended the relationship?” The big advantage about firing customers is that it frees up sales and account management time. This time can be used for more profitable activities such as cross-selling and upselling to Ambassadors, or for converting Rationals into Ambassadors.

2. If the answer is FIRE THEM, find a ‘beautiful exit’

Stalkers and Opponents have a corrosive influence on your company. They sap energy and consume resources that can be better used elsewhere. They also have a corrosive influence on other clients as they spread a negative message about your capabilities and services. Have that tough conversation with the client before the situation deteriorates, and help them move to a competitor. Do it cleanly and professionally. Find what Finnish Business Professor Kimmo Alajoutsijarvi refers to as a Beautiful Exit to the relationship – a disengagement that “minimises damage to the disengager, the other party, and the connected business network.”

3. If the answer is KEEP THEM, put a proper recovery plan in place

Many of Deep-Insight’s clients will put a Service Improvement Plan (SIP) in place for poor-scoring accounts, typically Opponents or Stalkers. These SIPs involve a significant increase in service support to that client. They also require an open and honest conversation between the Account Director and the most senior people in the client organisation. In large complex B2B client relationships, changes in behaviour are typically required on both sides to bring the relationship back on an even keel again. Don’t be afraid of saying to your client: “We’re committed to making improvements on our side, but we need you to do X and Y for this relationship to work.” (more…)

Susan – Sales Director

Susan – Sales Director Bill – Marketing Director

Bill – Marketing Director