Deep-Insight works with clients across all industries. From experience we know it’s tougher to deliver services consistently well in some industries than in others.

One particularly tough industry is Outsourcing. Outsourcing services include IT, payroll, finance, manufacturing, call centres, washroom services and so on. In fact, there are very few functions and processes that have not been outsourced. This phenomenon is not just confined to the private sector. Some of the biggest outsourcing deals involve the provision of services to local, regional and central government clients.

Over the past two decades, outsourcing has become commonplace. Companies have focused on core areas of expertise and hived off the remaining functions to specialist firms. The theory is simple: focus on your core competences and leave the rest to firms that can run those activities better, faster and cheaper. Unfortunately, many of these arrangements fail to deliver the expected benefits. Many service providers get badly burnt when large outsourcing contracts spiral out of control.

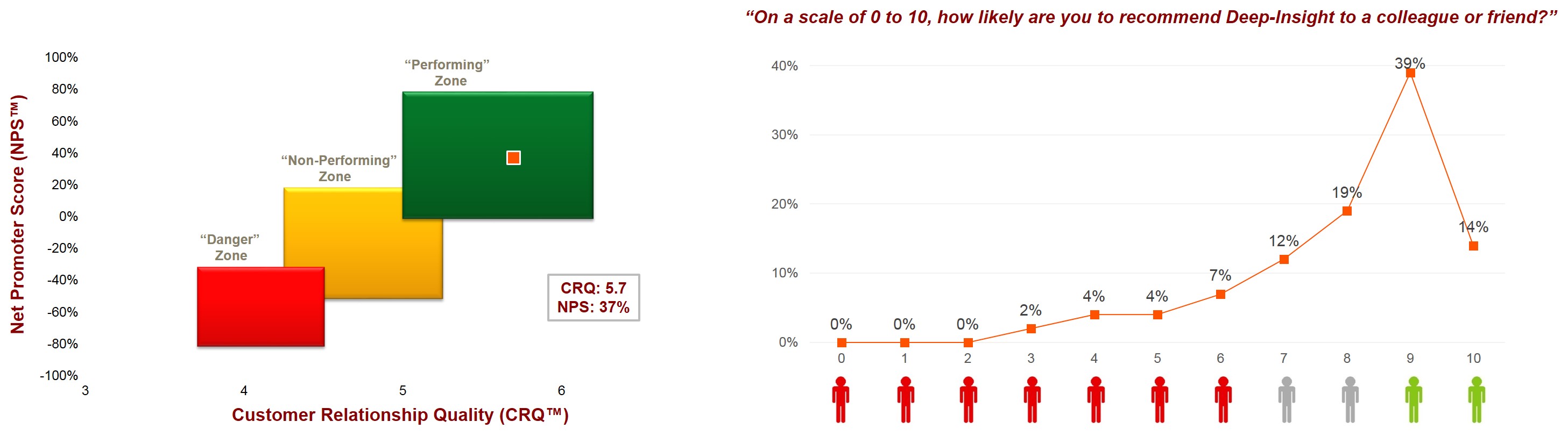

I spend a lot of my time with leadership teams helping them understand what their major corporate (and government) clients think of them. When I present their customers’ feedback – in the format of Customer Relationship Quality (CRQ) and Net Promoter Scores (NPS) – one of the most common questions I get asked is “Are those scores typical in our industry?”

Put it another way. Clients want to know what a ‘good’ CRQ or NPS score is for their industry.

Some industries are different

Many executives tell me that their industry is different. My standard response is that the nature of a business relationship is the same regardless of industry. There should be little difference in CRQ or NPS scores across industries. The fundamentals of business relationships are the same.

And yet, in practice, some industries ARE different. For example, corporate banks seem to find it easier to build strong relationships with their clients than companies that provide complex outsourcing solutions.

So why is this? Why is it so difficult for Outsourcing companies to get really good customer feedback and scores? And – back to the title of this blog – what is a ‘good’ Net Promoter Score if you operate in the Outsourcing industry?

7 Deadly Sins of Outsourcing

Several academics such as Jérôme Barthélemy have tried to address this question. Jérôme has identified the “7 Deadly Sins of Outsourcing” – the pitfalls that companies blunder into when they make a decision to outsource a process or entire function to a service provider. These seven sins are:

– Outsourcing activities that should not be outsourced

– Selecting the wrong vendor

– Writing a poor contract

– Overlooking personnel issues

– Losing control over the outsourced activity

– Overlooking the hidden costs of outsourcing, and

– Failing to plan an exit strategy (i.e., vendor switch or reintegration of an outsourced activity)

The Terrible Three

It’s not just the company that’s doing the outsourcing that’s at fault. The vendors – or outsourcing service providers – have their own deadly sins, the most common of which (the Terrible Three) are the following:

– The Sales/Delivery Gap. This typically happens when a vendor has a ‘bid team’ that competes for new contracts. Before the ink is dry on the contract, the bid team has moved on to the next major deal. They leave the delivery and implementation to a completely different team that looks at the contract and shouts: “WHAT? You expect us to deliver that? With those resources? And for that cost?”

– The Efficiency Challenge. Outsourcing providers need economies of scale to make money. The unit cost of providing payroll services to 10 companies is lower than to a single company, but only if the service provider can establish a large efficient ‘factory’ for the delivery of these services. In most cases, the ‘factory’ managers operate on principles that are based on efficiency and cost containment rather than on delighting the customer.

– The Offshoring Issue. One way of achieving lower costs is through ‘offshoring’ – locating the ‘factory’ in another part of the world where labour costs are significantly lower. So the UK service provider moves the IT development to India. The Australian service provider transfers the call centre functions to the Philippines. Nothing wrong with that, as long as it’s meticulously planned and executed. Very often it’s not, and even when it is, there are always teething problems.

What is a GOOD Net Promoter Score for an Outsourcing company?

In a previous blog I said that an ‘average’ Net Promoter Score for a European B2B company is in the region of +10 and that scores in excess of +30 are excellent.

Our experience is that an ‘average’ NPS score for Outsourcing companies is negative – typically in the region of -10 and that any NPS result in positive territory can be regarded as a good result.

So there you have it. Zero CAN be a good Net Promoter Score for some European B2B companies!

If you are a senior executive in a company that provides outsourcing services, you can settle for mediocrity and target your staff to achieve a zero or slightly positive NPS. Alternatively, you can work with your clients to make sure they avoid the 7 Deadly Sins (as well as making sure you avoid the Terrible Three internal sins). If you’re successful, you’ll outperform the competition and make much greater profits for you and your shareholders.

The other thing I’m particularly pleased with is the fact that we are back into the ‘Unique’ zone – that’s the light green box in the top right hand corner of the graphic. To be seen as unique, a company has to be able to provide a solution that truly solves its customers’ problems, as well as providing an excellent experience for that client. That’s something that only 10% of B2B companies achieve so it’s nice to be able to claim that accolade again.

The other thing I’m particularly pleased with is the fact that we are back into the ‘Unique’ zone – that’s the light green box in the top right hand corner of the graphic. To be seen as unique, a company has to be able to provide a solution that truly solves its customers’ problems, as well as providing an excellent experience for that client. That’s something that only 10% of B2B companies achieve so it’s nice to be able to claim that accolade again.